macro help

Hello @kaylak What is your question?

cba

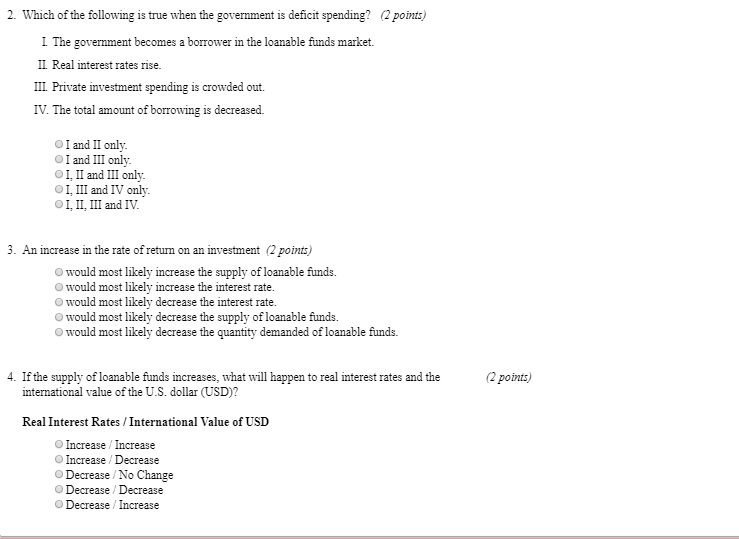

Had to do some reading as macroeconomics is not my forte. Anyway, deficit spending by the government is when the United States of America (for example) starts spending more than what it's taking in (spending more than it's taxation). A couple of things happen as a result of this. One is that the government becomes a borrower in the loanable funds market. This is because one of the ways that the government borrows money (to spend) is through bonds, which anyone can buy. This also effectively crowds out private investment.

This site goes over the government side of things: https://www.nationalpriorities.org/budget-basics/federal-budget-101/borrowing-and-federal-debt/ This site goes over the crowding out effect and how it can be correlated to rises in the real interest rate: https://www.investopedia.com/terms/c/crowdingouteffect.asp

am i correct

It looks like it for the first two, looking at the third one now

ok ty so much

is 3 correct i have some more to check

For three I would go with D, because when you raise the supply in something, that increases competition thus people lower the cost of such loans (or the interest rate in this case) to look more enticing. This also reduces the value of the U.S. dollar, because when there is more of something, it is usually valued less.

In this case though, it happens because of that interest rate decrease.

i mean cad

that's wat i have

Join our real-time social learning platform and learn together with your friends!